Enter or change default nominal accounts

Find this screen

Open: Settings > Cash Book / Nominal Ledger > Default nominal accounts.

How to

Enter the default profit and loss accounts

On the Profit and Loss tab:

- Select the Code from the drop-down list for each default account in the list.

The nominal account must have a report category Report Type of Profit and Loss. If it hasn't, the code is highlighted in red.

Before you can save, you must set the Suspense Account on the Profit and Loss tab.

Enter the default balance sheet accounts

On the Balance Sheet tab:

- Select the Code from the drop-down list for each default account in the list.

The nominal account must have a report category Report Type of Balance Sheet. If it hasn't, the code is highlighted in red.

Before you can save, you must set the Accumulated Profit

Useful info

How the default nominal accounts are used

The following tables explain how each default account is used in Sage 200, the processes they affect, and the whether you can change the default when entering transactions.

|

Account |

When used |

Applied to |

Can be changed on transactions |

|---|---|---|---|

|

Suspense Account * |

When a nominal account that doesn't exist is specified for a transaction or process. |

Any transaction without a valid nominal account |

No |

|

Exchange Differences 1 |

The currency gain or loss when foreign currency receipts are allocated to invoices. The difference between current balance on customer, supplier or bank accounts and the balance after revaluation. |

Sales Allocation Purchase Allocation

Customer account revaluation Supplier account revaluation Bank account revaluation |

No |

|

Bank Charges |

For bank charges added to foreign currency receipts and payments. When to set this

If you incur bank charges on foreign currency bank transactions. |

Nominal payments and receipts Customer payments and receipts Supplier payments and receipts |

Yes |

|

Discount Allowed 1 |

The settlement discount amount when it's specified on receipts. When to use this

If you offer your customers a settlement discount. |

Customer receipts |

No |

|

Discount Taken 1 |

The settlement discount amount when it's specified on payments. When to set this

If you receive settlement discounts from your suppliers. |

Supplier payments |

No |

|

Default Sales |

The net value of sales. Added to new customer accounts. When to set this

Setting this makes sure that sales are always posted to a P & L account and not the suspense account. When not to set this

When transactions are posted to many different accounts and you want to choose the nominal account each time. If this is not set, you must either:

|

Sales invoices and credit notes posted directly to the customer accounts |

Yes |

|

Default Purchases |

The net value of purchases. Added to new supplier accounts. When to set this

Setting this makes sure that purchases are always posted to a P & L account and not the suspense account. When not to set this

When transactions are posted to many different accounts and you want to choose the nominal account each time. If this is not set, you must either:

|

Purchase invoices and credit notes posted directly to the supplier accounts |

Yes |

|

Bad Debt Write Off 1 |

Writing off small amounts on customer or supplier accounts. |

Write off customer small amounts Write off supplier small amounts |

No |

|

Bad Debt Expense 1 |

Writing off bad debts on customer accounts and reclaim any VAT charged. |

Write off customer bad debt |

No |

* - these are mandatory and must be set.

1 - these are used automatically and we strongly recommend that you set these.

The Depreciation default nominal account is not used by Sage 200.

|

Account |

When used |

Process |

Can be changed on transactions |

|---|---|---|---|

|

Creditors' Control 1 |

Gross value of supplier transactions |

All supplier transactions. |

No |

|

Debtors' Control 1 |

Gross value of customer transactions |

All customer transactions. |

No |

|

Unauthorised Purchases 1 |

This is the Balance Sheet liability account where unauthorised supplier invoices are posted. |

Posting unauthorised supplier invoices. |

No |

|

Bank Account 1 |

As a default for new bank accounts |

Add new bank account |

Yes |

|

Default VAT Input 1 |

VAT on supplier transactions. |

All purchase transactions with VAT |

No |

|

Default VAT Output 1 |

VAT on customer transactions. |

All sales transactions with VAT |

No |

|

Bad Debt Provision |

Writing off bad debts on customer accounts and reclaim any VAT charged. |

Provide and correct Customer Bad Debt |

No |

|

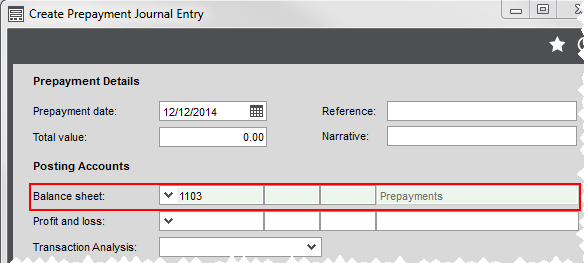

Prepayments |

For the prepayment journal when you spread an expense across several accounting periods. |

Prepayments |

No |

|

Accruals |

For the accruals journal when you want to estimate an expense over several accounting periods. |

Accruals |

No |

|

Accumulated Profit * |

The total of your profit and loss nominal accounts. We recommend that you don't manually post transactions to this account. |

Year End |

No |

|

Stock |

The cost value of the purchase of stock items on your balance sheet. Added to new stock items. When to set this

When you want to record the cost of your stock items in the same nominal account. When not to set this

You want to use different nominal accounts to record the cost value of your stock items. If this is not set, you must either:

|

POP invoice and credit note |

Yes |

|

Accumulated Profit Fund * |

The remaining balance of your funds at the end of the year. Sage 200 automatically moves the remaining balance of each fund to a balance sheet account, as part of the year end process. The balance of P & L accounts is cleared to zero. We recommend that you don't manually post journals to this account. |

Year end and funds brought forward for the SOFA report. |

No |

* - these are mandatory and must be set.

1 - these are used automatically and we strongly recommend that you set these.

What if I don't set a default?

This depends on the type of default accounts. You don't have to set a default but not setting one has different consequences for different types of accounts:

You must set these before you can save.

Suspense account - Sage 200 must have a suspense account before any transactions can be processed. Any transactions that don't have a valid nominal account are posted this account.

Accumulated Profit - The balance of all Profit and Loss accounts is transferred here as part of the year end process. The balance of all Profit and Loss accounts is cleared to zero.

Accumulated Fund Profit - The remaining balance of your funds is transferred here as part of the year end process. If you're an Academy, the account you specify here must also have a SOFA category of SX99.

We strongly recommend that you set a default account for these. Sage 200 always posts to these accounts and they're not displayed when the transactions are entered.

If you don't set default accounts for these, then transactions will be posted to the suspense account.

| Name | Type |

|---|---|

|

Suspense Account |

P & L |

|

Exchange Differences |

P & L |

| Discounts Allowed | P & L |

| Discounts Taken | P & L |

| Bad Debt Write Off | P & L |

| Bad Debt Expense | P & L |

|

Debtors' Control |

BS |

|

Creditors' Control |

BS |

| Unauthorised Purchases | BS |

|

VAT input |

BS |

|

VAT output |

BS |

| Bad Debt Provision | BS |

|

Accumulated Profit |

BS |

| Accumulated Fund Profit | BS |

The default account set here is displayed when completing certain processes. If you don't set a default here, then you'll have to choose an account as part of the process.

For example, when entering a prepayment, the Prepayment default account is displayed.

Applies to these default accounts

| Name |

|---|

| Bank charges |

| Prepayments |

| Accruals |

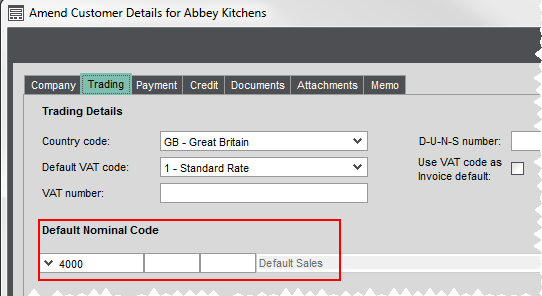

The default set here is chosen automatically when creating new customer accounts (Default Sales), supplier accounts (Default Purchases), bank accounts (Bank Account), or stock records (Stock). Once set on record, the account is then entered by default each time a transaction is entered for the customer, supplier or stock item.

If you don't set a default here, then you'll need to choose a default account on each customer, supplier, bank, or stock item record.

This is useful If you have certain transactions that are always posted to the same nominal account. Setting a default means you can be sure that your records and your transactions always have a nominal account specified. This helps to prevent transactions being posted to the suspense account.

Even if you don't use the same account for every transaction, it's a good idea to set default nominal accounts. Even if someone forgets to change the nominal account, at least the value is posted to the right areas of your profit and loss or balance sheet.

Applies to these default accounts

| Name |

|---|

| Default Sales |

| Default Purchases |

| Bank Account |

| Stock |

The default set here is chosen automatically when creating new customer accounts (Default Sales), supplier accounts (Default Purchases), bank accounts (Bank Account), or stock records (Stock). Once set on record, the account is then entered by default each time a transaction is entered for the customer, supplier or stock item.

Only set a default account if the majority of customers, suppliers or stock items will need to post to the same nominal code. Your staff will still need to need to select accounts with the correct fund (cost centre) and department on transactions.

Applies to these default accounts

| Name |

|---|

| Default Sales |

| Default Purchases |

| Bank Account |

| Stock |

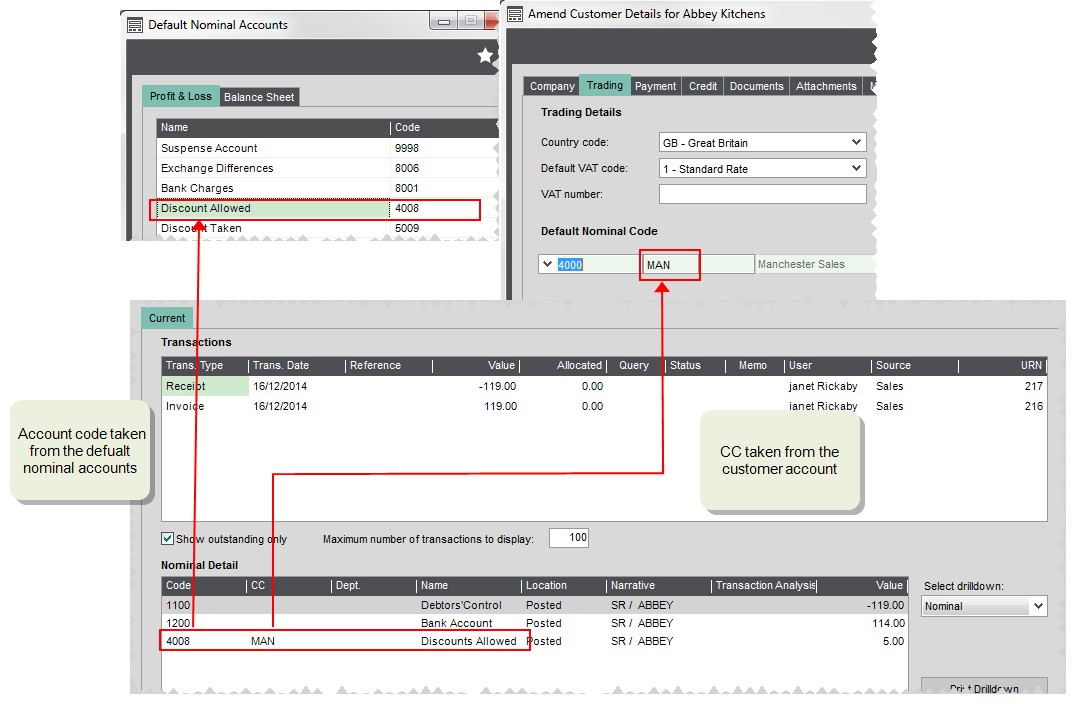

Using cost centres and departments

If you are using cost centres and departments with your nominal accounts, your Profit and Loss transactions post slightly differently.

Once you have set a nominal account with a CC or CC/Dept, as the default nominal account on a customer or supplier account, Sage 200 posts to the account Code associated with the default nominal account and the CC/ Dept associated with the customer or supplier account.

For example, a settlement discount for a customer with a default nominal account of 4000 MAN, would post to a Discounts Allowed nominal account, 4008 MAN.

If you are using cost centres and departments with your nominal accounts, you must make sure that you create accounts with all the required CC or CC/Dept combinations for all nominal accounts used on your Profit and Loss.

John is setting up Sage 200 within his company. His company is comprised of three branches. He wants to produce a P & L for each branch, as well as his the company as a whole, so he creates three cost centres to represent this. These are:

- London - LON

- Manchester - MAN

- Birmingham - BIR

To make sure the value of each transaction is recorded correctly, John creates a set of Profit and Loss nominal accounts for each cost centre.

His list of nominal accounts starts to look something like this:

| Code | CC | Name |

|---|---|---|

| 4000 | MAN | Sales |

| 4000 | BIR | Sales |

| 4000 | LON | Sales |

| 4008 | MAN | Discounts Allowed |

| 4008 | BIR | Discounts Allowed |

| 4008 | LON | Discounts Allowed |

| 5000 | MAN | Purchases |

| 5000 | BIR | Purchases |

| 5000 | LON | Purchases |

| 5009 | MAN | Discounts Taken |

| 5009 | BIR | Discounts Taken |

| 5009 | LON | Discounts Taken |

| 8006 | MAN | Exchange Differences |

| 8006 | BIR | Exchange Differences |

| 8006 | LON | Exchange Differences |

| 9100 | MAN | Bad Debt Expense |

| 9100 | BIR | Bad Debt Expense |

| 9100 | LON | Bad Debt Expense |

| 9101 | MAN | Bad Debt Write Off |

| 9101 | BIR | Bad Debt Write Off |

| 9101 | LON | Bad Debt Write Off |

When he sets up his default nominal accounts, he choose the required Code. His Profit and Loss default nominal accounts are:

| Code | Name |

|---|---|

| 4000 | Default Sales |

| 4008 | Discounts Allowed |

| 5000 | Default Purchases |

| 5009 | Discounts Taken |

| 8006 | Exchange Differences |

| 9100 | Bad Debt Expense |

| 9101 | Bad Debt Write Off |

About report categories

The accounts you choose here must have the correct Report Category as this determines whether the are Profit and Loss Accounts or Balance Sheet accounts.

Report categories are used to create your financial statements. They divide your nominal accounts into Profit and Loss or Balance Sheet and then into groups for reporting on the correct section of each financial statement.

It is very important that you make sure your report categories have the correct Report Type (Profit and Loss or Balance Sheet), and correct Category Type (Asset, Liability, Income or Expense). This is because these determine how the value from your nominal accounts are reported on your financial statements. In addition, the values in all Profit and Loss nominal accounts are set to zero, when you move Sage 200 into a new financial year (Year End).

About SOFA categories

SOFA categories are used to group your nominal accounts together to report the income and expenditure of your funds on the SOFA report.

To record funds brought forward from the previous year on the SOFA report, you need to have a special default nominal account for Accumulated Fund Profit.

If you're an Academy, this account must also have a SOFA category of SX99 - Funds Brought Forward, to make sure your brought forward funds are correctly included on the SOFA report.

Year end for your funds

As part of the year end process, the remaining balance of any of your funds needs to be transferred to a balance sheet account. This is account specified as the default for Accumulated Fund Profit.

The remaining balance for each fund is transferred to the accumulated fund profit account with the corresponding cost centre. If these accounts don't exist when you run the year end, then Sage 200 creates them for you.

If you're an academy, you must also add the SOFA category for Funds brought forward to each account. This is to make sure your brought forward funds are included on the SOFA report.

-

Create an account for Accumulated Fund Profit. This account should have:

- The same report category that you use for Retained Profit, e.g. BS23 - Reserves.

- If you're an academy, a SOFA category of SX99 - Funds Brought Forward.

- Set this account as the default for Accumulated Fund Profit (Settings > Cash Book / Nominal Ledger > Default Nominal Accounts | Balance Sheet).

-

Create additional accounts with the same code, for each of your cost centres. A quick way to do this is to use the Generate Accounts screen. (Nominal > Create and Amend Accounts > Generate New Nominal Accounts)

See an exampleAccount Code Cost Centre Fund Type Report Category Report category Type SOFA Category 3300 CIF Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 EFA Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 FAF Restricted Fixed Asset BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 GAG Unrestricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 RES Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 SEN Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 UN Unrestricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward

Fix it

The code has a red highlight

This means that the nominal account you've selected doesn't have the correct report category Report Type. The report category of the nominal account will have a Report Type of either Profit and Loss or Balance Sheet. So when you select an account, Profit and Loss defaults must have a report category type of Profit and Loss, and Balance Sheet defaults must have a report category type of Balance Sheet.

To resolve this:

- Change the nominal account selected, or

- Check that the nominal account has the correct report category, or

- Check that the account's report category has the correct Report Type.

I see an error message when I try to save

Before you can save the changes made to the default nominal accounts, you must have entered an account for both of the following:

-

Suspense Account (Profit and Loss tab).

-

Accumulated Profit (Balance Sheet tab).

-

Accumulated Fund Profit ( Balance sheet tab)

What happens when

The default accounts are saved?

The next time any transactions are entered, they are posted using the new defaults you've specified.

Be careful when you change the default nominal accounts, as this will change how your Profit and Loss or Balance Sheet is reported.